Lufthansa has submitted a bid to acquire a minority stake in ITA Airways, the successor to Italy’s loss-making Alitalia airline.

If the bid is successful, the German carrier will become the latest to attempt to steer Italy’s national carrier to profitability after numerous previous failed attempts and billions of euros in state aid. The move is also the latest sign of what’s expected to be significant consolidation of the European aviation industry in the wake of the Covid-19 pandemic and the threat to legacy carriers from low-cost airlines.

In this post:

Lufthansa Submits €200-€300 Million Bid for 40% of ITA Airways

While Lufthansa has confirmed that it has submitted has submitted a bid for a minority stake in ITA Airways, it has not disclosed the size of the stake or the price. However, Reuters is reporting based on sources close to the matter that the bid is for a 40% stake valued at €200-€300 million.

The deal, if approved, would put Lufthansa in a stronger position in Italy, one of Europe’s key aviation markets, and access to valuable trans-Atlantic routes.

In a statement, Lufthansa said, “Italy is the most important market outside of our existing home markets and the United States. It is a prominent business and tourism destination.” The airline also emphasized the importance of developing Italy’s main hubs and guaranteeing ITA access to strategic markets.

Why Lufthansa Wants ITA Airways

The acquisition of ITA Airways would be a strategic play for a virtual monopoly over wide swaths of key European markets for Lufthansa. Key for Lufthansa would be the strategic location of its hubs at the center of the continent, well positioned for connectivity compared to its competitors.

Taking over ITA is also a defensive move by Lufthansa allowing it to protect its dominant position and prevent a rival from building up a base in Milan that could potentially draw passengers away from Lufthansa’s Munich hub.

The move comes as Europe’s airlines struggle to recover their balance sheets post-pandemic and as legacy carriers look to consolidation to remain competitive. Italy’s Economy Ministry has said that Lufthansa is the only bidder and will now review the offer to decide whether to approve it.

However, some analysts have raised concerns about the message the bid sends about Lufthansa’s capital allocation, as the successful restructuring of ITA into a sustainably profitable airline is not guaranteed. Bernstein analysts Alex Irving and Clementine Flinois said in a note, “yes, Italy is an important, attractive market – but the successful restructuring of ITA into a sustainably profitable airline is far from assured.”

Star Alliance Dominance Over Europe

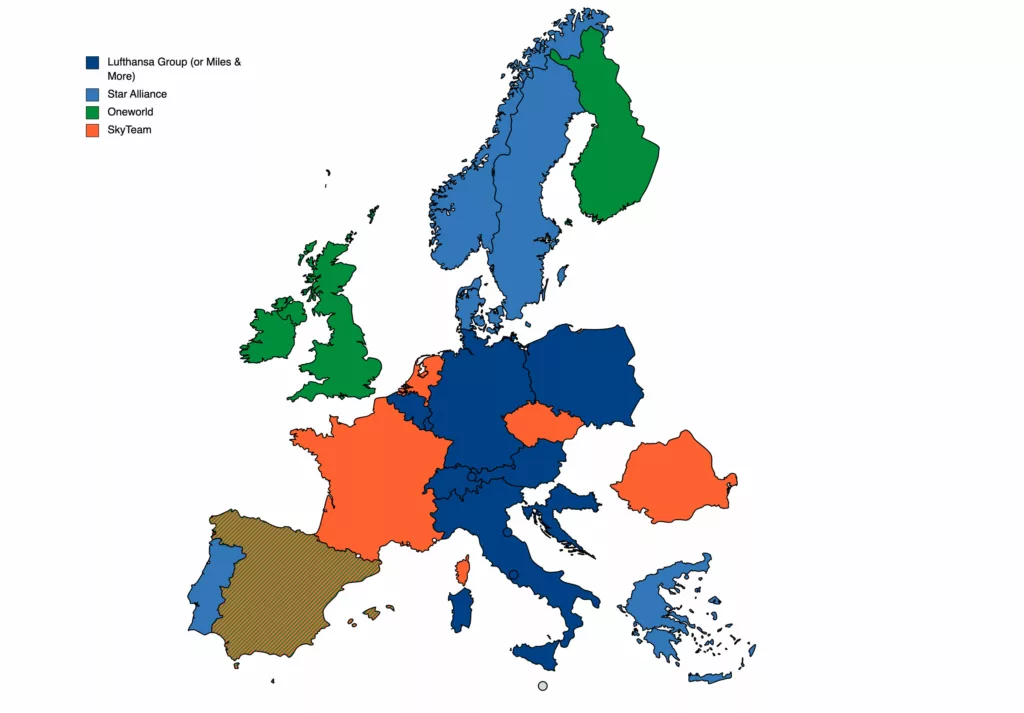

If this deal is approved, Lufthansa would have a lock on key markets in Germany, Belgium, Switzerland, Austria, and Italy including all-important northern Italy. Taking into account Star Alliance members and non-aligned carriers who utilize Lufthansa’s Miles & More loyalty program, Lufthansa’s dominance of the European aviation market and motivations for the acquisition become clear.

Together with SAS Scandinavian Airlines, LOT Polish Airlines, Aegean, TAP Portugal, and smaller players, Star Alliance would have a dominant position in over half of Europe’s key markets. A big advantage for Lufthansa and Star Alliance.

On the other hand, SkyTeam would be left with just Air France-KLM as its main player in Europe with hubs in Paris and Amsterdam. The alliance would have minor players with Air Europa in Madrid (should it stay in SkyTeam…) and TAROM in Romania, but that still leaves it severely outgunned against Star Alliance dominance across Europe. (Yes, we’re excluding Czech Airlines and its lone route between Prague and Paris here).

Meanwhile, Oneworld would continue to rely heavily on British Airways and its powerhouse hub at London Heathrow. Finnair is also dominant at Helsinki but it suffers from an inconvenient location for most intra-European connections.

The alliance has Iberia in Madrid but it controls a much smaller percentage of traffic at its main hub than other major players in Europe. That could change if Spanish authorities get their way and Iberia’s proposed merger with Air Europa moves forward.

Bottom line

German carrier Lufthansa has submitted a bid to acquire a minority stake in ITA Airways, the successor to Italy’s loss-making Alitalia airline. The bid is reportedly for a 40% stake valued at €200-€300 million, and if approved, would give Lufthansa dominance in one of Europe’s key aviation markets and access to valuable trans-Atlantic routes. It would also allow Star Alliance to consolidate a clear lead among airline alliances in Europe at SkyTeam’s expense.

0 Comments